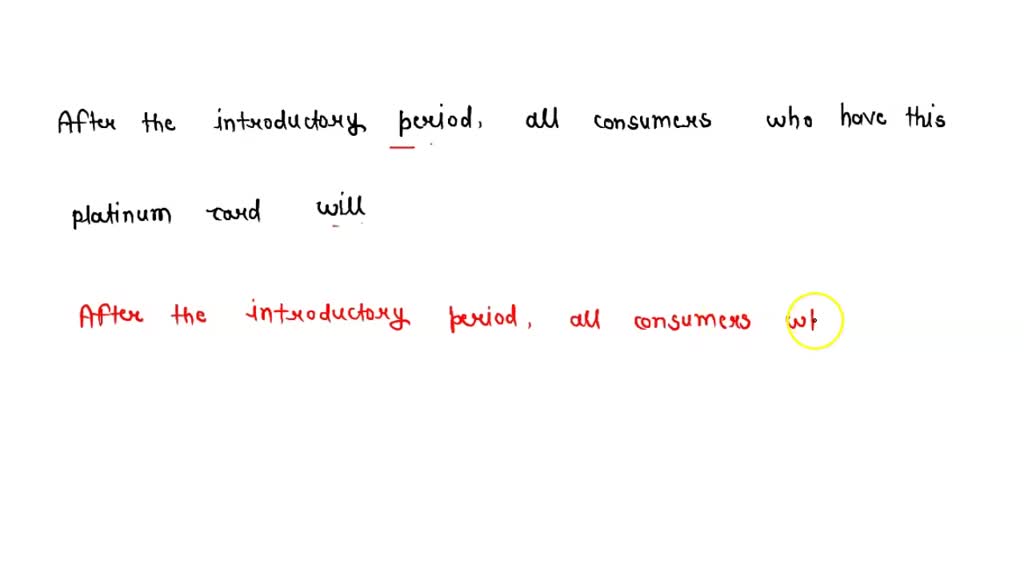

After the Introductory Period, All Consumers Who Have This Platinum Card will

Picture this: you’ve just received the Platinum Card, and you’re excited to explore all the amazing benefits it offers. But what happens after the introductory period? Well, that’s what we’re here to uncover! After the introductory period, all consumers who have this Platinum Card will experience a world of exclusive perks and privileges that will make every moment more memorable. No more FOMO (fear of missing out) because with this Platinum Card, you’ll have access to a wide range of exceptional experiences and unparalleled rewards. It’s like having a VIP pass to a world full of excitement and possibilities. So buckle up and get ready for the ride of a lifetime! But wait, there’s more! Along with all the incredible benefits, having this Platinum Card also means being part of an exclusive community of like-minded individuals who appreciate the finer things in life. It’s not just a card, but a gateway to a world where luxury and convenience go hand in hand. So, are you ready to embark on this extraordinary journey? Just sit back, relax, and let us guide you through what awaits you after the introductory period with this extraordinary Platinum Card. Get ready for a life filled with unforgettable moments, boundless opportunities, and the thrill of having it all at your fingertips. Excited? You should be! Let’s dive in together!

After the introductory period, all consumers who have this Platinum Card will enjoy a range of exclusive benefits. From enhanced rewards programs to access to premium airport lounges, this card is designed to elevate your financial experience. Additionally, cardholders can take advantage of travel insurance coverage, extended warranties, and purchase protection. With this Platinum Card, you’ll have peace of mind knowing that your purchases and travels are protected. Apply today and start reaping the rewards!

Exploring the Benefits of the Platinum Card: What Happens After the Introductory Period?

Are you considering getting a Platinum Card but wondering what comes after the introductory period? Fear not, as we delve into the exciting benefits and opportunities that await all consumers who have this prestigious card. From travel perks to exclusive rewards, the Platinum Card continues to elevate everyone’s experience long after the initial offer ends. Let’s dive into the details and discover why this card stands out from the rest.

Unlocking a World of Travel Rewards

After the introductory period, all consumers who have this Platinum Card will gain access to a plethora of travel rewards that will enhance every adventure. With this card in hand, you can expect benefits such as complimentary or discounted airport lounge access, priority boarding on select airlines, and even free hotel upgrades. These perks make your travel experience smoother, more luxurious, and truly unforgettable.

Beyond traditional travel rewards, the Platinum Card goes the extra mile with exclusive offers and partnerships. From discounts on luxury car rentals to personalized travel itineraries curated by experts, this card offers a level of sophistication that sets it apart from the competition. Whether you dream of exploring exotic destinations, embarking on a culinary tour, or immersing yourself in breathtaking cultural experiences, your Platinum Card will be your perfect companion.

In addition to the travel perks, a Platinum Card also grants you access to a range of exclusive events and experiences. Imagine attending a coveted fashion show, a concert by your favorite artist, or a private tasting at an award-winning winery. With this card, you gain entry into a world of luxury and excitement, where memorable moments await at every turn.

The Versatility of Membership Rewards

One of the standout features of the Platinum Card is its versatile Membership Rewards program. After the introductory period, all consumers who have this Platinum Card will continue to earn valuable points on their everyday spending. These points can be redeemed for a variety of rewards, including travel, shopping, dining, and entertainment experiences.

With the Membership Rewards program, you have the flexibility to choose how to use your points. Whether you prefer to book flights, enjoy a shopping spree at your favorite luxury retailer, or indulge in a gourmet dining experience, the possibilities are endless. And to make things even more exciting, the Platinum Card often offers bonus points for certain categories of spending, allowing you to accumulate rewards faster and enjoy the benefits sooner.

Moreover, the Platinum Card provides access to exclusive partnerships with popular brands and retailers, offering cardholders unique opportunities to maximize their Membership Rewards points. From discounts on stylish fashion labels to special rates at renowned hotels, the Platinum Card ensures that your points go further and bring you even more value.

Peace of Mind with Extensive Travel Insurance

When it comes to travel, peace of mind is priceless. After the introductory period, all consumers who have this Platinum Card can enjoy the assurance of extensive travel insurance coverage. Whether you encounter flight delays, lost baggage, or require emergency medical assistance while abroad, the Platinum Card has you covered.

Travel insurance provided by the Platinum Card includes coverage for trip cancellations, lost or delayed luggage, medical emergencies, and even rental car accidents. This comprehensive insurance package allows you to explore the world with confidence, knowing that unexpected events will not disrupt your travels or leave you with hefty expenses.

In addition to travel insurance, the Platinum Card also provides purchase protection for eligible items. Suppose something you buy with your card is accidentally damaged or stolen within a specified period. In that case, you can rely on the card’s purchase protection to reimburse you for the cost of repair or replacement, ensuring that you can shop worry-free.

Achieve an Elite Lifestyle with the Platinum Card

The Platinum Card offers much more than exclusive travel benefits and rewards. It opens the door to a world of luxury, personal assistance, and elevated lifestyle experiences. After the introductory period, all consumers who have this Platinum Card will gain access to a host of services designed to cater to their every need.

Imagine having your own personal concierge available 24/7 to assist with everything from travel arrangements to restaurant reservations. Need help planning a special occasion or finding the perfect gift? The Platinum Card’s concierge service is there to make it happen, ensuring every detail is taken care of and every desire fulfilled.

Furthermore, the Platinum Card offers additional lifestyle benefits such as access to exclusive events, culinary experiences, and even private shopping sessions. Step into a world of VIP treatment, where you can enjoy the finest things in life and create memories that will last a lifetime.

The Security and Convenience of Contactless Payment

In this digital age, convenience and security are paramount. The Platinum Card offers the latest in payment technology, including contactless payment options. After the introductory period, all consumers who have this Platinum Card will enjoy the ease and speed of making payments with just a tap, eliminating the need for physical contact or entering PIN numbers.

Not only does contactless payment provide a seamless transaction experience, but it also enhances security. With advanced encryption technology and fraud detection measures, you can rest assured that your transactions are protected from unauthorized access. Say goodbye to bulky wallets and enjoy the freedom of contactless payment with your Platinum Card.

In summary, the Platinum Card continues to impress long after the introductory period ends. With travel rewards, versatile points programs, extensive insurance coverage, elite lifestyle benefits, and convenient payment options, this card truly offers a world of possibilities. So, if you have this Platinum Card, get ready to unlock a lifetime of extraordinary experiences and elevate your journey to new heights.

Key Takeaways:

- After the introductory period, all consumers who have this Platinum Card will have different benefits and features.

- It’s important to carefully review the terms and conditions of the Platinum Card to understand the benefits and fees involved.

- The Platinum Card offers various perks, such as travel rewards, exclusive access to events, and concierge services.

- To make the most out of the Platinum Card, it’s recommended to use it for frequent travel and take advantage of its travel-related rewards.

- Having the Platinum Card gives consumers a sense of premium membership and access to exclusive privileges.

Frequently Asked Questions

Welcome to our Frequently Asked Questions section for the Platinum Card. Find answers to common queries about the card’s benefits and features below.

1. What happens after the introductory period ends?

After the introductory period, all consumers who have this Platinum Card will transition to the regular interest rate. This rate will be based on their creditworthiness and the terms and conditions of their card agreement.

The regular interest rate may be higher than the introductory rate, so it’s important for cardholders to review their agreement and understand any applicable fees or charges during this period.

2. Are there any additional benefits after the introductory period?

Absolutely! Even after the introductory period ends, all consumers who have this Platinum Card can continue to enjoy a wide range of benefits.

These benefits include access to exclusive events, complimentary airport lounge access, travel insurance, extended warranty protection, and much more. Cardholders can make the most of these perks long after the introductory period is over.

3. Can I still use my Platinum Card if I miss a payment after the introductory period?

Missing a payment can have consequences, even after the introductory period ends. If you miss a payment, you may incur late fees and interest charges.

However, it’s important to note that the specific penalties will depend on your card agreement and the terms set by the card issuer. It’s always best to make payments on time to avoid any financial repercussions.

4. Can I upgrade or downgrade my Platinum Card after the introductory period?

Yes, it is often possible to upgrade or downgrade your Platinum Card after the introductory period. However, it’s important to check with your card issuer for their specific policies and requirements.

Keep in mind that upgrading or downgrading a card may come with certain conditions or fees, so it’s crucial to fully understand the implications before making any changes to your account.

5. How can I keep track of my spending after the introductory period ends?

Managing your spending after the introductory period is essential for maintaining financial wellness. Fortunately, most card issuers provide online account management tools.

These tools allow cardholders to monitor their spending, set spending limits, receive notifications for transactions, and more. It’s a convenient way to stay on top of your finances and ensure responsible credit card usage.

Summary

Here’s a quick recap of what we learned about the Platinum Card: You can get the Platinum Card and enjoy a special introductory offer. After that, you’ll need to pay an annual fee. With the card, you can earn points on your spending, which can be redeemed for rewards like travel or shopping vouchers. Remember to make your payments on time to avoid extra charges.